Profits boom at top 20 funds including TCI, Citadel, Viking and Pershing Square thanks to rebound in stock markets

Billionaire hedge fund managers Chris Hohn and Ken Griffin led the industry to record profits last year as bets on the stock market paid off handsomely for clients.

The top 20 hedge fund managers made $67bn (£53bn) in profits for investors in 2023, as the industry made combined profits of $218bn, topping the previous record of $65bn set in 2021.

TCI Fund Management, which is run by British billionaire Hohn, who paid himself $346m last year, topped the list making $12.9bn for clients.

Citadel, founded by the US billionaire Ken Griffin, who has been involved in a bid for the Telegraph newspaper with the co-owner of GB News, ranked second, making $8.1bn.

Trying to figure out if I can afford groceries this week.

Go look outside in your hedge.

Why did they do this meme with Warren? By all accounts he’s one of the “better” billionaires. This should be Bezos, or one of the Devos or Koch assholes.

Hes not a better billionaire, he has better PR and he knows to shut up and disappear when hes the one being an asshole, like during the rail workers strike. Not every billionaire has the disease Trump and Elon have where they don’t know how to shut up. And there are much worse people, who get away with it, because they know how to shut up. Honestly its so bad with them that I bet if Trump simply knew when to shut up he’d be aquited by now.

A better billionaire would donate the majority of their money losing billionaire status.

Buffett has already donated the majority of his wealth, otherwise he would be wealthier than Musk.

He also announced that whatever is left when he dies will be donated as well, and publicly challenges other billionaires to do the same.

The patagonia guy “donated” his wealth too – to a nonprofit that is run by and directly benefits his family, avoiding massive amts of taxes. I’m sure Warren will be a good Billionaire, though, even though that’s an oxymoron.

Donations can reduce your taxes, but you always lose more from the donation than you get back in tax breaks.

There’s levels to everything. I’d say Bezos, Devos, Koch, Waltons are far far worse and have done massive damage to our country.

Every year or so I get an order at work from Koch. They suck so very hard at engineering but they have so much money. It took me a while to notice it but every “engineer” I worked with over there was super good at giving you the impression that they knew what they were doing but didn’t infact know. Their paperwork looks great, they talk a great talk And that is where it ends.

Just in case this insight is useful to you since you rightfully hate Koch.

I hate them for starting the Tea Party and starting us down the path of Trump insanity.

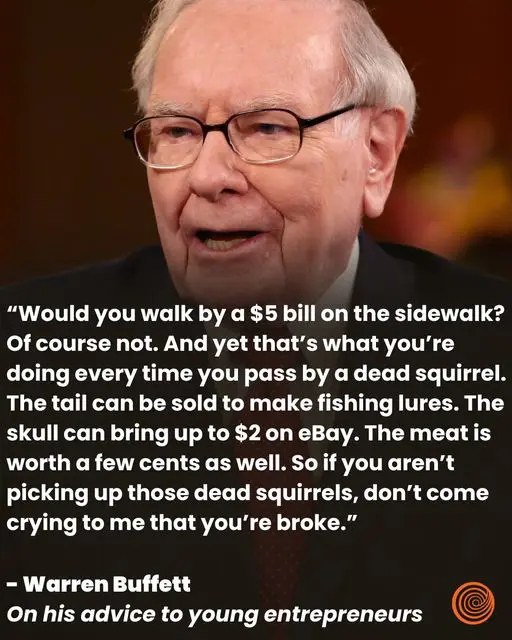

Probably because the dead squirrel is reminiscent of Buffett’s “cigar butt” investing philosophy.

I call this the ‘cigar butt’ approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit

But Buffett ultimately gave up that philosophy when he started working with Munger.

he’s one of the “better” billionaires

I’m moving in with my parents to pay off debt. EDIT: Ironically, a large portion of the debt was incurred by paying for groceries with credit cards.

Can we get some fucking pitchforks already?

Eat the rich

They should not exist…

deleted by creator